The Australian Securities and Investments Commission (ASIC) has reissued Regulatory Guide 34 Auditor obligations: Reporting to ASIC (RG 34). RG 34 describes situations that ASIC believes represent a significant contravention of the Corporations Act 2001 (the Act) that an auditor must report under subsections 311, 601HG, 990K, and 1226H of the Act.

Among other changes, the revised RG 34 tightens the auditor’s reporting obligations regarding the late lodgement of financial reports.

Your auditor’s reporting obligations to ASIC for late lodgement

The revised RG 34 clarifies that ASIC considers an entity’s failure to lodge its financial report by the due date is a significant contravention of the Act.

In ASIC’s view, your auditor should notify ASIC if they become aware that the entity has failed to lodge its financial report on time, and in any case:

- For listed or disclosing entities: Immediately upon failure to lodge by the due date.

- For all other entities: If the report remains outstanding 28 days after its due date.

ASIC’s approach to addressing breaches

An entity’s failure to lodge a financial report within the deadline required by subsection 319(1) of the Act is a strict liability offence. ASIC can impose substantial fines on an entity – currently up to $198,000 per event – for failing to comply with its lodgement obligations under subsection 319(1) of the Act. Alternatively, ASIC could seek court-imposed penalties of up to $396,000.

ASIC’s enforcement priorities for 2026 include financial reporting misconduct, including failure to lodge financial reports within their deadlines.

Your statutory lodgement responsibilities

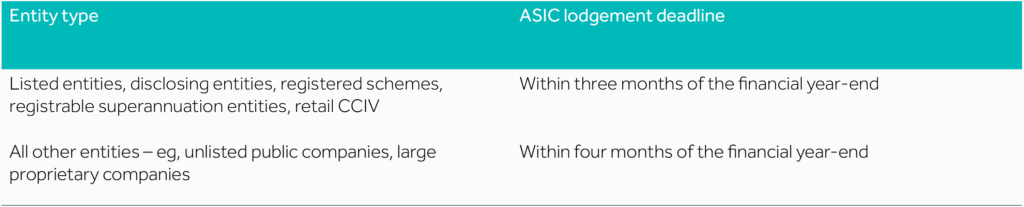

The statutory requirements of the Act relating to the lodgement of financial reports with ASIC remain unchanged. The lodgement deadline depends on the entity type:

Entities that have not lodged a financial report with ASIC when required should do so without further delay.

Those who are unable or unlikely to meet their reporting deadlines are encouraged to seek an extension of time by applying for relief through the ASIC Regulatory Portal. Refer RG 51 Applications for relief.

Next steps

If you have any questions about these updates, connect with your local Nexia Advisor for tailored guidance and to stay confident in meeting your obligations.